17th February 2021

How much will you be taxed as an apprentice?

Curious about your entitlement as an apprentice in a workplace compared to a regular employee? We answer all of your questions when it comes to tax during your time as an apprentice.

IronmongeryDirect

17th February 2021

5 mins

Apprenticeships allow you to get applicable experience, relevant qualifications and a head start in your chosen career. As an apprentice, you’ll do a combination of work and training overseen by an employer and an educational facility. You’ll be entitled to many of the same benefits as regular employees, including a wage.

However, apprenticeship wages are different to standard wages. The National Minimum Wage for apprentices is lower than for standard workers, and employers can set their own rates as long as they’re higher than this. With wages being slightly different for apprentices, what does that mean for tax?

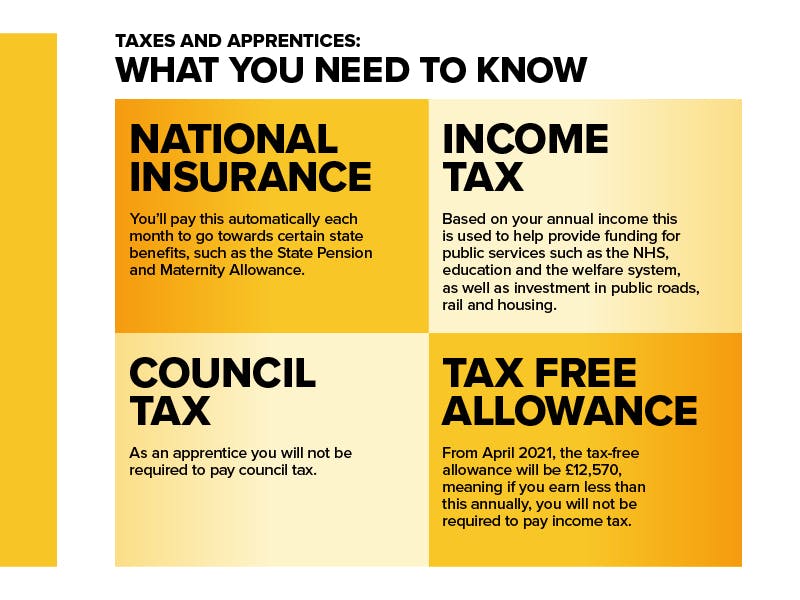

What is tax?

In simple terms, tax is a payment you make to the government. It’s a compulsory payment – meaning it’s actually illegal not to pay it. It goes towards services such as the NHS, armed forces, welfare and public services, sport, culture and education – including the money the government puts towards apprenticeships.

Do apprentices have to pay tax?

Apprentices, just like standard employees, do have to pay tax. You’ll be assigned a suitable tax code – which can be found on your wage slips – that tells HMRC how much tax you need to pay each month, based on your wage, age and other personal circumstances. This is arranged by your employer and HMRC, so you won’t need to do anything beyond providing the relevant ID when you start your new apprenticeship.

How much tax would I pay as an apprentice?

How much tax you pay depends on how much money you earn. As of 2021, you don’t have to pay any tax if your yearly earnings are less than £12,500. If you earn between £12,501 and £50,000 annually, you’ll pay the Basic Rate of tax, which is 20% of your total earnings in tax. If you earn over £50,000, you’ll pay the Higher Rate of 40%, and the Additional Rate of 45% if you earn over £150,000 each year. Tax rates do change over time, but you can find the latest information on the government’s website.

How do I pay my tax?

Unless you’re self-employed, it’s likely your tax is being automatically deducted from your wage each time you receive payment. This is called Pay As You Earn, or PAYE. If you’re working for an employer and not as a sole trader, HMRC take this money out of your wage before you’re paid the final amount – so don’t worry, you don’t need to do anything.

What happens if I pay too much or too little tax?

Sometimes you can be assigned the wrong tax code - or even an emergency tax code if HMRC didn’t receive all of the information needed to correctly calculate your tax payments. When you first receive your wage slip, make sure to check your payments against the tax rates applicable to you. If you’ve paid too much tax, you could be entitled to a refund – but if you pay too little, you may be asked to pay everything you owe later down the line. If you think you’ve been paying an incorrect amount, contact HMRC as soon as you can.

For more helpful information about trade careers, including taking and running apprenticeships, don’t forget to take a look at our other blogs. You can find high-quality ironmongery products over on our homepage.